MyPay is a new way to access up to $5001 of your pay before payday. Chime uses your direct deposit amount, history, and other factors to determine how much you can access with MyPay. During each pay period, you can see your credit limit and the “Available now” amount that you can access that day. Eligible members can access between $20 and $500 each pay period. Money available to you can be accessed right from the Chime app. You can use MyPay advances to receive money within 24 hours for free or instantly for a 3% fee of the advance amount, with a built-in minimum and maximum fee amount ($2 minimum and $5 maximum) per advance. Instant advances are optional and do not impact the amount available to you.

Frequently asked questions

How do I sign up for MyPay?

Does MyPay have any fees or interest? (2)

- There is no interest.

- There is no mandatory, annual, or late fee for using MyPay.

- There is no cost for MyPay scheduled advances, and money will arrive in your checking account within 24 hours, after requesting an advance.

- There is an option to get funds instantly for 3% fee of the advance amount, with a built-in minimum and maximum fee amount ($2 minimum and $5 maximum) per advance.

Will MyPay impact my credit score?

How does accessing money with MyPay work?

- Go to MyPay.

- Tap Get Money.

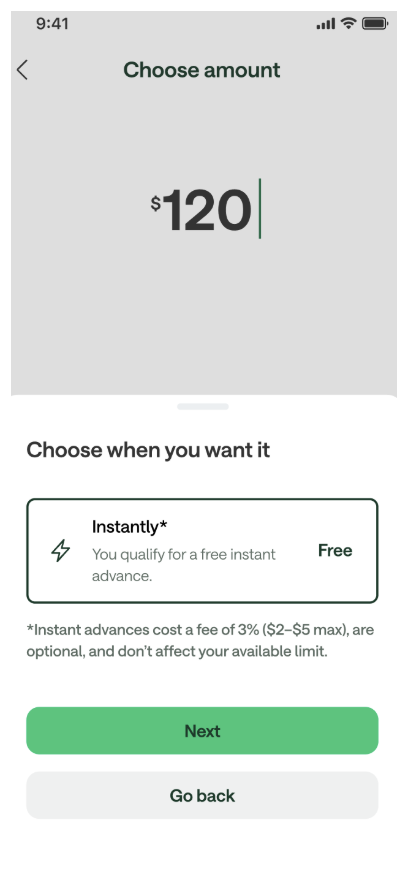

- Enter the amount of money that you would like to receive, and tap Next.

- Tap the option for how fast you want to access it:

- You can tap the option Instantly for a 3% fee of the advance amount, with a built-in minimum and maximum fee amount ($2 minimum and $5 maximum), or

- You can tap the option Within 24 hours to access it for free

- Tap Next.

- Review the information on the screen including:

- The amount of your advance

- Your new checking account balance

- You must also check the authorization box confirming Chime will debit your Chime Checking Account for repayment

- Tap Confirm.

- Choose the account you would like your advance deposited to.

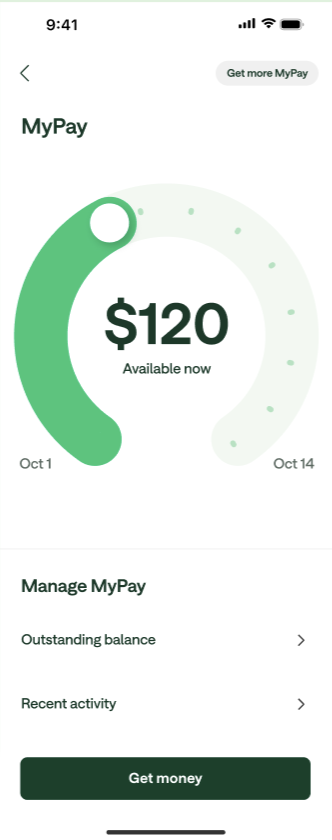

For members in the MyPay dial redesign experience:

Note: We're currently testing a new design for MyPay with a limited group of members. If you're part of this test, you may see updates to the MyPay experience in your app. This redesign will roll out gradually, and when it's available to everyone, it will update automatically in your app.

Open the Chime app and go to MyPay.

Scroll to the amount you’d like to request on the MyPay dial or tap on the dollar amount in the center to enter the advance amount you’d like to request.

The dial gives you a visual understanding of how much advance you’ve already taken, your ‘Available now’ amount, and how your MyPay may increase each day (up to your Credit Limit) during your pay period. Learn more about How does MyPay® repayment work?.

Tap Get Money.

Choose how quickly you want the funds:

Instantly (for a 3% fee of the advance amount, with a built-in minimum and maximum fee amount ($2 minimum and $5 maximum)), or

Within 24 hours (free)

Tap Next.

Review the details shown:

The advance amount

Your updated checking account balance

Be sure to check the authorization box confirming repayment from your Chime Checking Account

Tap Confirm to complete your request.

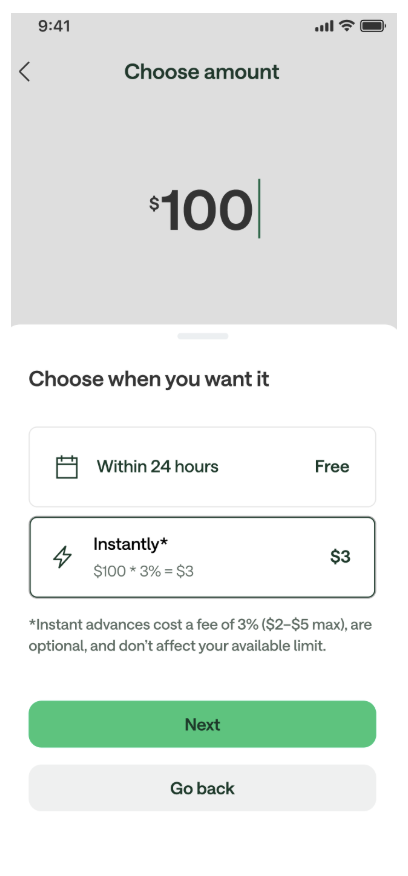

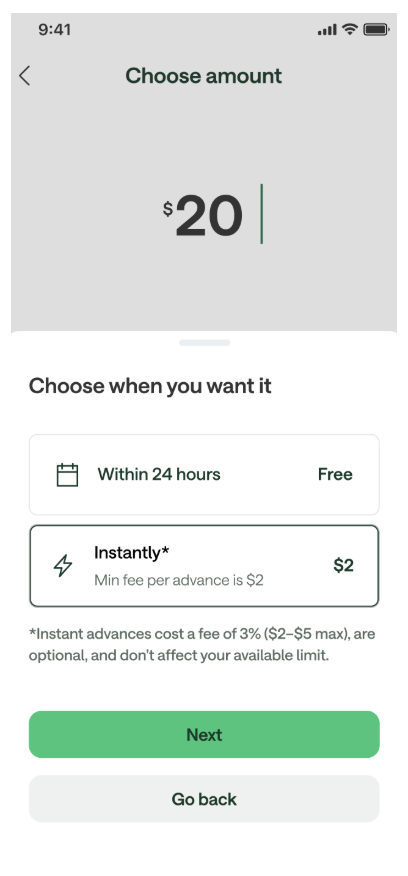

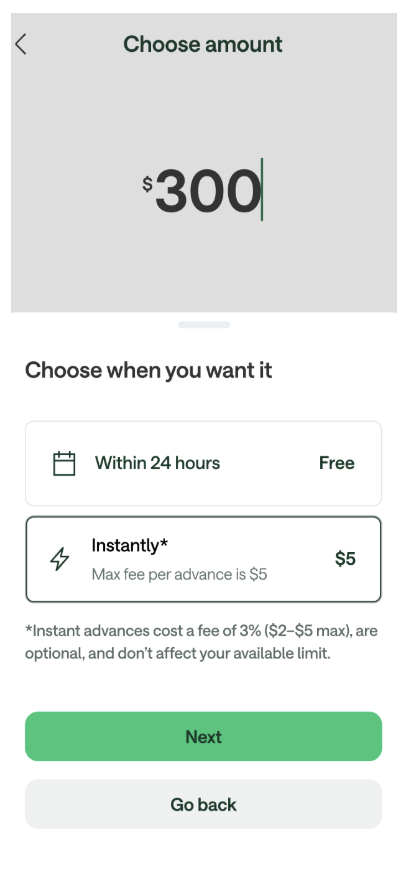

How do I check what the MyPay instant advance fees will be in the app?

Go to the MyPay Hub.

Tap Get My Money.

Choose the amount you’d like to advance and tap Next.

In the Choose where you want it section, look under Instant.

The app will automatically calculate 3% of your advance amount.

If the 3% is less than $2, your fee will show as $2.

If the 3% is more than $5, your fee will show as $5.

If the 3% is between $2 and $5, you’ll see that exact amount displayed.

Some members may qualify for a free instant advance and will see “Free” instead of a fee.

| 3% Fee | Minimum Fee | Maximum Fee | Qualifies for Free advance |

|  |  |  |

How much money can I access with MyPay?

What is “Available now”?

Why did my “Available now” amount change?

What is the Credit limit?

What states is MyPay available in?

- Alabama, Alaska, Arkansas, Arizona, California, Delaware, District of Columbia, Florida, Georgia, Idaho, Iowa, Indiana, Kansas, Kentucky, Louisiana, Maryland (Chime Depositors only), Michigan, Mississippi, Missouri, North Carolina, North Dakota, Nebraska, Nevada, New Hampshire, New York (Chime Depositors only), Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Vermont, Virginia, West Virginia.

DISCLAIMERS

1 To be eligible for MyPay, you must receive Qualifying MyPay Direct Deposits to your Chime Checking Account as set forth in the MyPay Agreement. A Qualifying MyPay Direct Deposit is a deposit from an employer, payroll provider, gig economy payer, government benefits payer, or other source of income by Automated Clearing House (“ACH”) or Original Credit Transaction (“OCT”). Your MyPay Credit Limit and Maximum Available Advance may change at any time. MyPay is a line of credit and available limits are based on estimated income and risk-based criteria. Eligible members may be offered $20 - $500 per pay period. Your Limit and Maximum Available Advance will be displayed to you within the Chime app. MyPay is currently only available to eligible Chime members in certain states. Other restrictions may apply. See Bancorp MyPay Agreement or Stride MyPay Agreement for details.

2 Option to get funds instantly for 3% fee of the advance amount, with a built-in minimum and maximum fee amount ($2 minimum and $5 maximum) per advance or get funds for free within 24 hours. See Bancorp MyPay Agreement or Stride MyPay Agreement for details.