To maintain Chime+ status, you must receive at least one Qualifying Direct Deposit of $200 or more within the preceding 34 days.

How Does the 34-Day Rule Work?

- Chime+ is based on the preceding 34-days window.

- Each new Qualifying Direct Deposit of $200 or more resets your 34-day period.

- If more than 34 days pass without a Qualifying Direct Deposit of $200 or more, you will lose access to Chime+ status.

How Can I Track My Status?

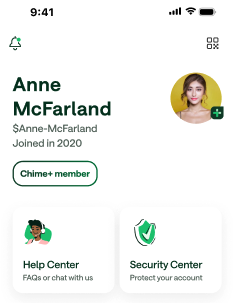

To check if you have Chime+:

- Open the Chime app.

- Go to Profile tab.

- Look for the Chime+ badge on your account.

What Happens If I Miss a Qualifying Direct Deposit?

- You will lose Chime+ status, including priority support and the higher savings APY1.

- You can regain Chime+ status again at any time by making a new Qualifying Direct Deposit of $200 or more.

Still need help, visit How do I contact Chime customer service?

Disclaimers

- The Annual Percentage Yield (“APY”) for the Chime Savings Account is variable and may change at any time. The disclosed APY is effective as of 3/26/25. No minimum balance required. Must have $0.01 in savings to earn interest. The Chime+ APY is available only while you maintain eligibility requirements for Chime+, otherwise the APY for non-Chime+ members will apply. See Chime+ Terms and Conditions for more details.

*To be eligible for Chime+™ status you must receive a Qualifying Direct Deposit to your Chime Checking Account in the preceding 34 days. Certain products marketed as Chime+ benefits have additional eligibility requirements. While some Chime+ benefits may have associated fees, none of these fees are mandatory to access Chime+ benefits or to maintain Chime+ status. See Chime+ Terms and Conditions for details.

CHIME+ is a Trademark of Chime Financial, Inc.